Retirement…

I have worked in the Financial Services industry since 1998. Much of that time has been spent working with clients nearing or already in retirement and I now find myself specialising in Retirement Planning.

I have extensive knowledge in Superannuation and Centrelink benefits for retirees and I have many great strategies for helping people boost their savings in the lead up to retirement, however I still have not managed to master the art of getting people to think about retirement before they are 50. I have come to realise that people are fearful of “retirement”.

Retirement has traditionally been defined as the cessation of full time employment, which brings with it fear. Fear of the unknown, fear of redefining who we are and what we will do with our time and fear of running out of money. Therefore, it is time to redefine retirement.

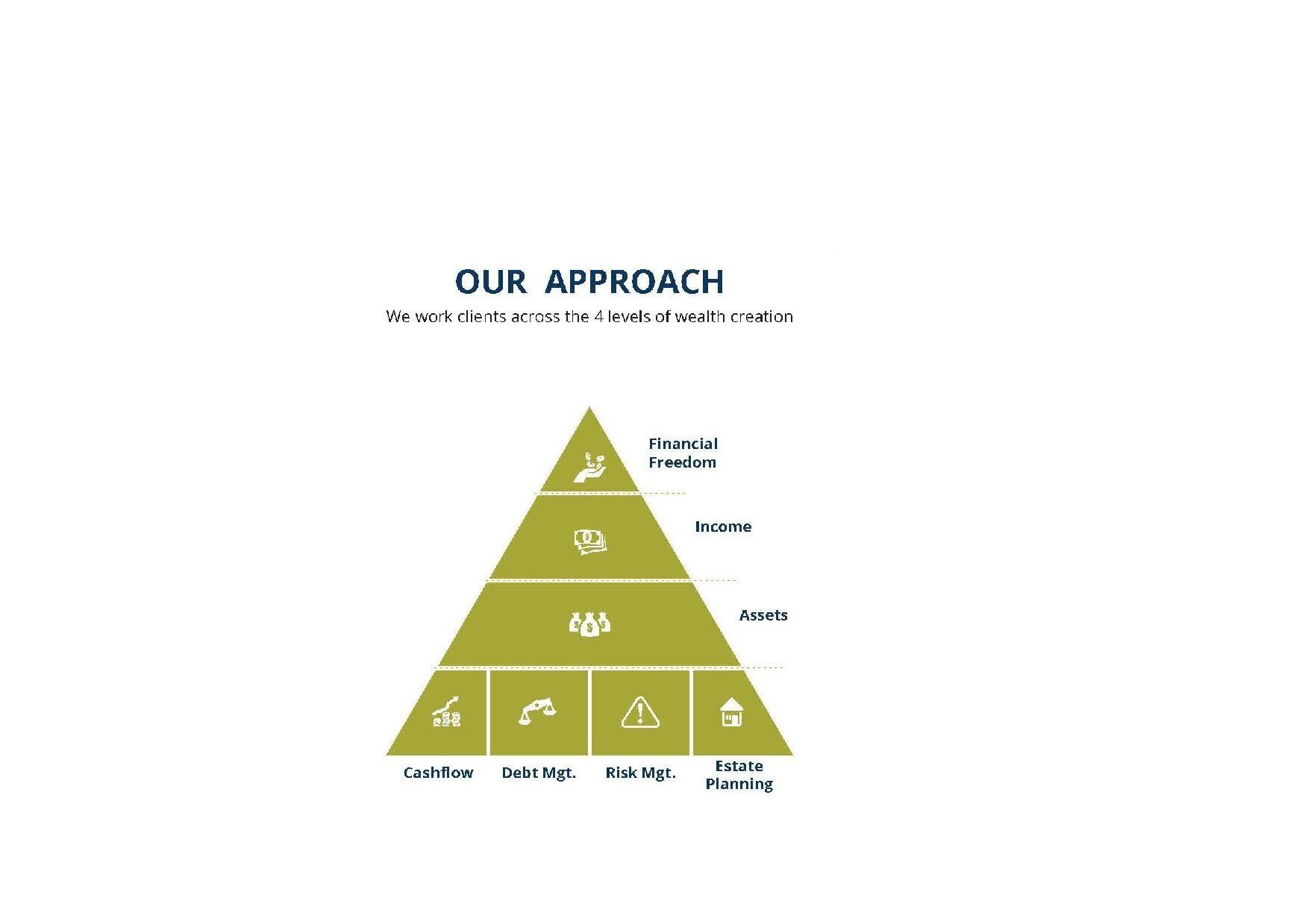

Instead of preparing for retirement, we should be preparing for Financial Freedom. Retirement does not necessarily mean giving up work, instead, it should mean having enough income from alternate sources that you no longer need to work. That is what Financial Freedom is, however the specifics of Financial Freedom will depend on the individual. Some people need $100,000 a year to live on, others can live comfortably on half of that. Some people want to drive a Porsche while others are comfortable in a Mazda. There is no right or wrong definition of Financial Freedom, however it will not be the same from one person to the next, so it is important for each family to define their own Financial Freedom.

Step 1. Define Financial Freedom

What does Financial Freedom mean to you? It could be owning your own home or putting your children through private school. It could be owning a Porsche or having the freedom to spend $100 a week on whatever you want without having to worry. Whatever Financial Freedom is to you, define it clearly.

For example:

Own home by 2021

Have $100,000 per year net free income

Put children through private school, cost $20,000 per annum, per child

Take annual holidays as a family, cost $5,000

Step 2: Income

Work out how much income you need to a) live day to day and b) have enough surplus to put towards a savings plan or to fund additional expenses, such as private school.

Step 3: Build assets

On top of your ability to earn an income, it is important to build sufficient, appropriate assets, that can generate an income for you to provide the lifestyle and choices that you desire.

Step 4: Foundation

Any good Financial Plan must start with the foundation, which is cashflow, debt management, risk management and Estate Planning.

Set a clear budget to determine how much surplus cashflow you have to put towards building assets.

Assess your debt situation and ensure you are not paying any more interest than you have to and implement cash management techniques to minimise the use of debt in the future.

Implement a risk management plan that protects you in case of an unexpected illness or death in the family. This could be through personal savings, but is generally implemented through the use of personal insurance cover.

Ensure your Estate is in order, by implementing an appropriate Will, which outlines what you want to happen with your assets, who will take care of your children on your passing and ensure your legacy lives on.

While this is step 4, in the planning stage, it is step 1 in the implementation stage.

By changing from preparing for Retirement to preparing for Financial Freedom, it is much clearer that this should be started as soon as we start earning an income, instead of waiting until we are winding down from work. It is never too late to start planning, but don’t wait another day. Start now and achieve Financial Freedom sooner.

If you need help putting the steps together, contact us today for a complimentary consultation.